Understanding Easements and Their Impact on Property Titles

When buying or selling property, the title process can seem overwhelming. One key aspect to review is the easement. Whether you’re a first-time homebuyer or an experienced investor, understanding easements and how they affect property titles is crucial for a smooth transaction. Here, we’ll explain what easements are, their impact on property titles, and why they matter in real estate.

What is an Easement?

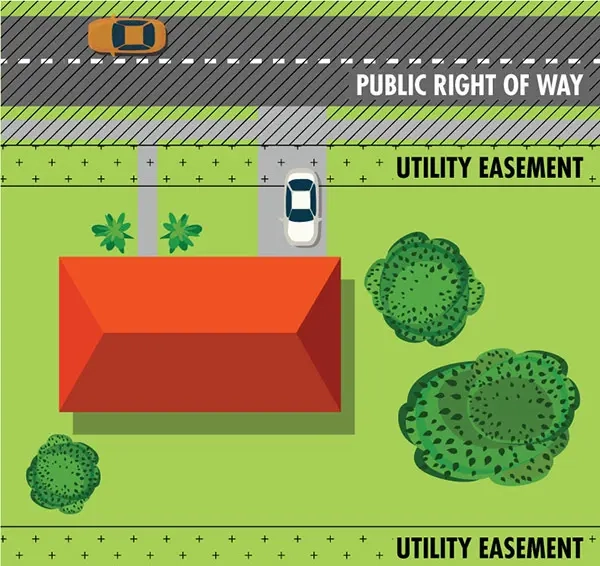

An easement is a legal right that allows one party to use another party’s property for a specific purpose. Easements typically apply to properties that share spaces or resources and often come up in real estate transactions. While easements don’t grant ownership, they allow the holder to use or access part of the property in specific ways.

Common types of easements include:

-

Utility Easements: Allow utility companies to install and maintain power lines, water pipes, and other infrastructure.

-

Access Easements: Give someone the right to cross land to reach a neighboring property.

-

Drainage Easements: Allow the flow of water or drainage across land, often important for flood-prone areas.

-

Conservation Easements: Restrict land development for environmental protection, such as preserving wetlands or wildlife habitats.

How Easements Affect Property Titles

Easements can significantly impact property titles and ownership. Here’s how:

Permanent Legal Rights

Easements are typically recorded in public records, meaning they remain attached to the property even if it’s sold. Buyers must check for easements that may limit their use of the land, as these rights stay in effect for as long as the easement agreement is in place.

Limitations on Property Use

Though you own the property, easements can limit its use. For example, an easement granting access to another property may prevent you from building a fence or structure that blocks the path. The easement terms will specify what can and can’t be done on the land.

Title Search and Easements

A title company conducts a title search to identify any easements recorded on the property. Buyers should review easements early to avoid surprises later. If a title search reveals an easement that could affect the property’s use, it may become a point of negotiation before completing the sale.

Potential for Disputes

While easements are legal agreements, disputes can still occur. For instance, a party may believe the easement is being misused or that the terms are unclear, leading to legal action. Buyers and sellers should review the easement terms carefully to avoid future disputes.

How to Handle Easements in a Real Estate Transaction

As a buyer or seller, consider these steps when dealing with easements:

Know Your Rights and Responsibilities

If you’re buying property with an easement, review the terms in detail. Understand the nature of the easement, who holds it, and their rights. If you’re selling, make sure all easement agreements are documented and disclosed.

Title Insurance Coverage

Title insurance typically covers easements that affect the property’s title, but discuss any concerns with your title company. They can explain how easements might impact the transaction and if additional coverage is necessary.

Consult Legal or Real Estate Professionals

If you’re unsure about how an easement will affect your property or transaction, consult a real estate lawyer or a title company professional. They can clarify any questions and help ensure you’re well-informed before proceeding.

Conclusion

Easements are an important aspect of property law. Understanding them will help you make informed decisions during real estate transactions. Whether you’re a buyer or a seller, working with a trusted title company and seeking legal advice can help you navigate any easement-related issues. By understanding how easements impact property titles, you protect your investment and ensure a smooth transaction.

If you’re buying or selling property, make sure to check for easements during the title search, and feel free to reach out to our team for assistance with any title concerns!